Table Of Content

If you have questions, consider reviewing Publication 523 or speaking with a tax advisor. But if you want to take advantage of the capital gains tax exclusion on home sales, you need to know the rules. Not all types of properties are eligible, and certain ownership factors can disqualify you from taking the exclusion. It's important for taxpayers to understand how selling their home may affect their tax return. When filing their taxes, they may qualify to exclude all or part of any gain from the sale from their income. Generally, taxpayers must report forgiven or canceled debt as income on their tax return.

Santa Fe City Council to propose a new tax on sale of homes worth more than $1M - KRQE News 13

Santa Fe City Council to propose a new tax on sale of homes worth more than $1M.

Posted: Wed, 05 Jul 2023 07:00:00 GMT [source]

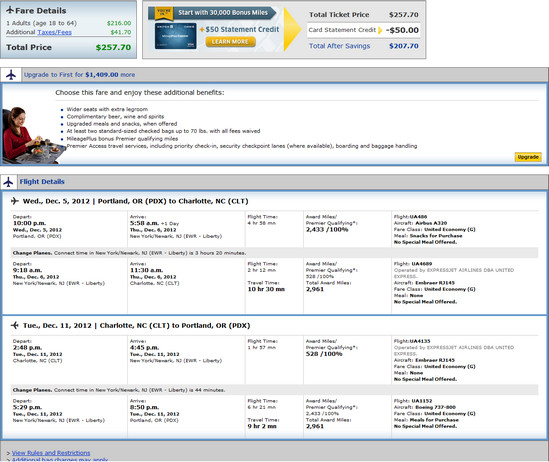

Short-Term vs. Long-Term Capital Gains Tax Rate in California

If you sell your stock, property or crypto and you’ve held it for more than one year, you get a classic tax break. Long-term capital gains are taxed at lower rates than ordinary income. If your taxable income is $47,025 or less, you pay zero tax on your long-term capital gain. If your taxable income is from $47,026 to $518,900, you’ll pay 15% on your long-term capital gain. You will not have to pay inheritance taxes if you inherit a California home. If you later sell the home, you will be responsible for paying capital gains taxes.

California transfer taxes

Short-term capital gains occur upon the sale of an asset that’s been held for less than a year. While tax rates vary, long-term capital gains are typically taxed less than short-term capital gains. The long-term capital gains tax rates are much lower than the corresponding tax rates for standard income. You may not need to pay the tax at all if you make less than the minimum amount listed below.

Divorce and tax basis

For tax purposes, these dates are calculated from the day after the original purchase to the date of sale of the property. Your home is not qualified for the exclusion if you purchased it through a like-kind exchange, also sometimes called a 1031 exchange, in the past five years. This kind of purchase basically means swapping one investment property for another. After June 25, in Ontario, at the top marginal tax bracket, if someone’s capital gain was $300,000 the increase in their taxes would be almost $4,500. If the capital gain is around $1 million, the individual pays around $67,000 more tax, according to calculations by Aaron Hector, private wealth adviser at CWB Wealth in Calgary.

Do I have to pay capital gains tax on my home? CPAs say sellers should ask for help - Deseret News

Do I have to pay capital gains tax on my home? CPAs say sellers should ask for help.

Posted: Fri, 08 Apr 2022 07:00:00 GMT [source]

What is the original cost of my home?

You will need to determine your basis in the inherited property. Your capital gains taxes are based on the gain or loss you realize from the home sale. If you’re looking to calculate capital gains tax, it’s highly recommended to seek advice from a tax professional to provide an accurate estimate. California does not have a separate capital gains tax rate, unlike some jurisdictions. California taxes you on the profit of your residential sale as if it were ordinary income you earned. The tax rate will depend on your marginal tax when calculating your California income tax.

How do I avoid the capital gains tax on real estate?

He also picked up some firsthand home building experience while significantly expanding and renovating his house to accommodate his growing family. Real estate taxes don’t need to be a surprise or intimidating. For starters, there are no estate or inheritance taxes in California. For example, if the fictional Jim and Susie pay the first installment in November and then sell their Sacramento home in December, it is now up to the buyers to cover the second installment due in the spring.

Did you buy a home with a high interest rate and intend to refinance later?

For a married couple filing jointly, only one spouse has to meet the ownership requirement. It’s important to note that these figures refer to profit, not income. This means that the tax is based on the net amount after expenses that you gain from selling your house. So it does not mean the total amount of money you make from selling your house, but rather the difference between the original purchase price and the sale price. Just as individual homeowners might choose to sell their home when their income is at a low ebb, businesses may want to offset capital gains with capital losses. When you sell your asset for less than your adjusted basis, the IRS considers that a capital loss.

Notably, though, the new 39.6% rate is only supposed to apply to taxpayers making $400,000 or more. California sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache. That’s why we came up with this handy California sales tax calculator. Most retailers, even some occasional sellers of tangible goods, are required to register to collect sales or use tax in California. CDTFA issues seller’s permits to business owners and allows them to collect tax from customers, file returns, and pay sales taxes to the state. If you have more than one home, you can exclude gain only from the sale of your main home.

When do I pay the capital gains tax on real estate?

If you have taxable capital gains, you may be required to make estimated tax payments. These numbers are just to give you an idea of how capital gains taxes work. If you renovated the kitchen or did any other significant improvements on the home, those costs could be added to your tax basis to reduce any potentially taxable gain.

This can sometimes present a problem for certain short-term buyers, like house flippers. For example, let’s say you earn a profit of $50,000 from flipping a home within 1 year. You also earn an annual salary of $50,000 from your regular job. You can't claim the exclusion if you already took it for another home in the two-year period before the sale of this home. If you inherited your home from someone other than your spouse in any year except 2010, your basis will generally be the fair market value of the home at the time the previous owner died.

Our ultimate guide for first-time homebuyers gives an overview of the process from start to finish. And from applying for a loan to managing your mortgage, Chase MyHome has everything you need. And even if you don’t qualify for a total exemption, you might be eligible for a partial exemption in California. The California rules for married couples or Registered Domestic Partners (RPD) are similar. Likewise, some events and activities can increase the cost basis.

Report as ordinary income on Form 1040, 1040-SR, or 1040-NR applicable canceled or forgiven mortgage debt. If you aren’t itemizing deductions on your return for the year in which you sold your home, skip to Reporting Other Income Related to Your Home Sale, later. Determine whether you need to report the gain from your home. If you completed “Business” and “Home” versions of your gain/loss worksheet as described in Property Used Partly for Business or Rental, earlier, complete this worksheet only for the “Home” version.